| Brian R. Barnes nmls # 238617 a.k.a 'The Loan Professor' |

Hours | Monday ~ Friday 9:00 to 8:00 PST Sat ~ 10:00 to 6:00 | Email 24/7 |

| 1.925.684.9720 |

| 1.925.684.9720 |

| We Can't Help Unless You Call! |

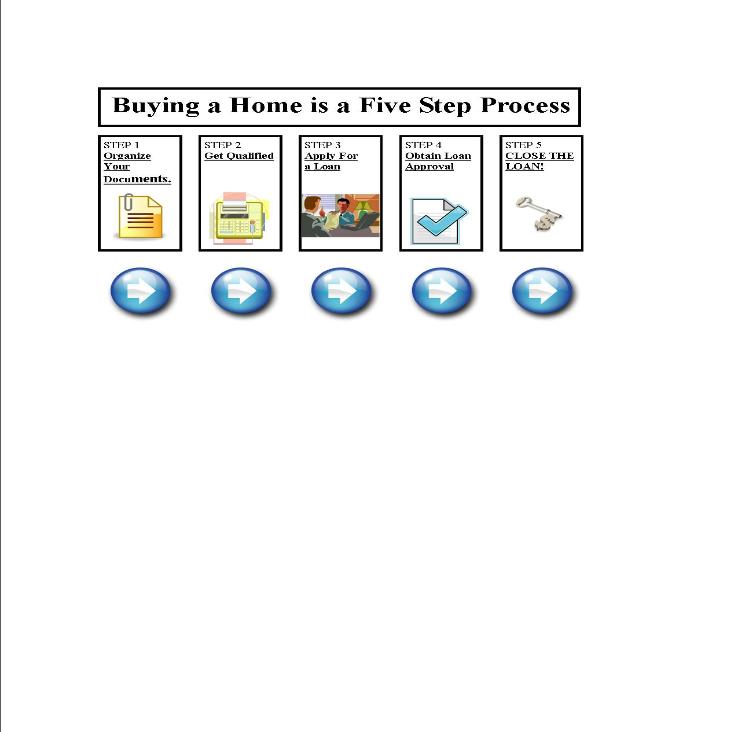

1) Organize Your Documents!

Before meeting with a Broker gather key items that are likely to be requested.

Here is a short list:

mistake of falling in love with a home that will break your budget.

2) Get Qualified!

The next step is to speak with a Broker and discuss your goals and needs. The broker should

pull your credit and discuss with you current loan programs and their pro's and con's. You will

need to make the decision which works best for you. The Broker can pre-qualify you and give

you a letter to take with you home shopping demonstrating the amount you are qualified for.

This is NOT an approval but it does show a seller that you are taking steps to secure financing.

This is a good time to start looking for a home.

3) Apply for a Loan!

The Broker will collect all necessary paperwork from you. An appraisal will be ordered and title

will be opened. The loan package will include all of your paperwork as well as items we will

collect such as the preliminary title report and appraisal. The lender will begin the underwriting

process and issue us a conditional approval.

4) Obtain Loan Approval

A Conditional approval will come with a few requirements (conditions) necessary for us to meet

to complete the loan. This may be additional documentation, letters of explanation etc. Once

these items have been cleared the lender will issue docs to title.

5) Close the Loan

Once the docs are in title you will go to the closing. This can be done at title or a mobile notary

can come to you. Here you will sign all of the final paperwork. All items from the Note to the

Deed will be notarized and sent back to the lender for final inspection. Once the lender signs off

that the paperwork was done correctly they will fund the loan. The very next day the deed will

be recorded and arrangements will be made for you to get the keys to your new home.

Before meeting with a Broker gather key items that are likely to be requested.

Here is a short list:

- Last 2 Months Pay Stubs and 2 W2's. If Self Employed Last 2 Years Taxes.

- Last 2 Months Bank Statements (to show reserves)

- Documentation of any other source of income.

mistake of falling in love with a home that will break your budget.

2) Get Qualified!

The next step is to speak with a Broker and discuss your goals and needs. The broker should

pull your credit and discuss with you current loan programs and their pro's and con's. You will

need to make the decision which works best for you. The Broker can pre-qualify you and give

you a letter to take with you home shopping demonstrating the amount you are qualified for.

This is NOT an approval but it does show a seller that you are taking steps to secure financing.

This is a good time to start looking for a home.

3) Apply for a Loan!

The Broker will collect all necessary paperwork from you. An appraisal will be ordered and title

will be opened. The loan package will include all of your paperwork as well as items we will

collect such as the preliminary title report and appraisal. The lender will begin the underwriting

process and issue us a conditional approval.

4) Obtain Loan Approval

A Conditional approval will come with a few requirements (conditions) necessary for us to meet

to complete the loan. This may be additional documentation, letters of explanation etc. Once

these items have been cleared the lender will issue docs to title.

5) Close the Loan

Once the docs are in title you will go to the closing. This can be done at title or a mobile notary

can come to you. Here you will sign all of the final paperwork. All items from the Note to the

Deed will be notarized and sent back to the lender for final inspection. Once the lender signs off

that the paperwork was done correctly they will fund the loan. The very next day the deed will

be recorded and arrangements will be made for you to get the keys to your new home.

We work hard to

provide the best

experience for our

clients. We secured

100% financing for

Marianna and she even

walked away from

closing with absolutely

no costs whatsoever.

Her good faith deposit

was even refunded at

closing!

"...By the way, you are

even greater than I

thought! Very exciting

news at closing today!!!

A very very happy and

excited Thank You!"

Marianna :)

provide the best

experience for our

clients. We secured

100% financing for

Marianna and she even

walked away from

closing with absolutely

no costs whatsoever.

Her good faith deposit

was even refunded at

closing!

"...By the way, you are

even greater than I

thought! Very exciting

news at closing today!!!

A very very happy and

excited Thank You!"

Marianna :)

| Equal Housing Opportunity All Rights Reserved © 2011 Brian R. Barnes # 238617. |

| Privacy | Glossary | About Us | Contact Us | Calculators | Credit Issues | FAQ | Secure Application | Loan Process |